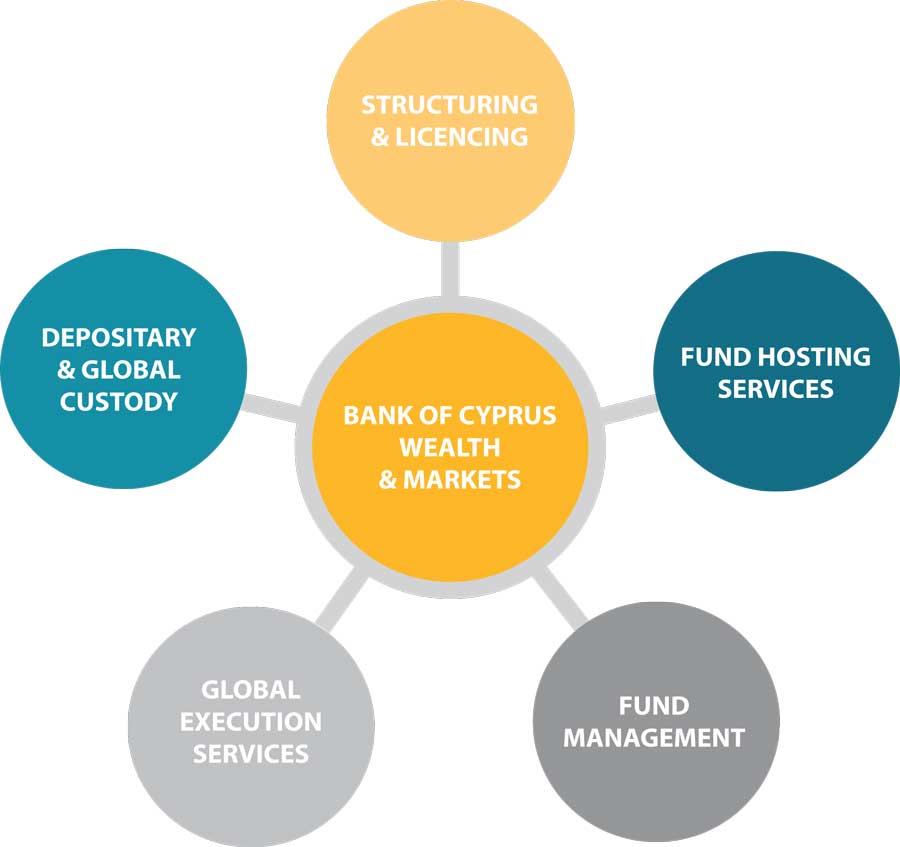

A COMPREHENSIVE SOLUTION FOR FUNDS

Bank of Cyprus (the “Bank”) is the leading banking and financial services group in Cyprus with a long history in servicing the investment management business through its Wealth and Markets Division. The many times awarded Wealth & Markets Division of the Bank, with a history of over 20 years in Asset Management, Private Banking, Institutional Wealth Management, Brokerage and Custody services, provides a wide range of specialized, investment-related services, to complement the Bank’s traditional banking services, in order to offer value added solutions to the Bank’s private high net-worth and institutional client base, including funds, portfolio managers and fund management companies. More specifically, the Wealth and Markets Division offers a comprehensive solution for AIFs and UCITS such as portfolio management, risk management, fund administration, depositary, execution and licensing.

Services Offered to AIFs and UCITS Funds

Structuring & Licensing Services

The Bank offers services related to the setting up and licencing of funds and fund managers in Cyprus. Through its wholly owned subsidiary, the Cyprus Investment and Securities Corporation Ltd (CISCO), which is supervised by the Cyprus Securities and Exchange Commission (CySEC) and operates under license number 003/03, it provides the following services:

- Advice and guidance on the choice of legal form, structure and fund characteristics as well as assistance with incorporation / formation of the fund

- Advice on the structure of the fund management company, its procedures, organisational structure, its functions and operations

- Drafting of the Prospectus and Key Investor Information Documents

- Coordination of all parties involved, such as auditors and investment managers during the processing of the application by CySEC until the licence is granted

- Preparation of annexes and other listing particulars, as required by CSE for listing the fund

Depositary & Global Custody Services

The Bank has applied its many years of experience in the global custody services sector by extending its offering to Depositary services for UCITS and AIFs. It is one of the local credit institutions offering Depositary services to AIFs and UCITS. Historically, it has been offering its clientele global custody services. It was a natural evolution, therefore to offer depositary services to funds. Such services consist of the following:

- Detailed review of the fund’s specifics to establish the efficient model of operation with the Manager

- Flexibility in setup to accommodate fund requirements and preferred operating model

- Cash flow monitoring and reconciliations

- Safekeeping of financial instruments, settlement and clearing

- Asset ownership verification for Other Assets like Private Equity

- Reach out locally to verify Other Assets’ ownership status

- Tax relief services for income received from major markets

- Oversight on subscriptions and redemptions

- Verifications in regards to the valuation of shares

- Monitoring income distributions

- Access to more than 55 markets and 190.000 mutual / hedge funds through quality custody network of Clearstream SA, a leading global custodian

Fund Hosting Services – Fund Administration & Risk Management

Fund administration is offered by BOC Asset Management Ltd (BOCAM). BOCAM is a fully licensed UCITS Management Company supervised by the CySEC and operating under licence number 5/78/2012. The primary function of BOCAM is the management of UCITS. Given its expertise, BOCAM is able to offer fund administration solutions to third parties, UCITS managers and AIFs managers as well as self-managed AIFs, which have been incorporated according to the relevant legislation of the Republic. BOCAM offers a comprehensive and tailor-made solution to meet your fund requirements, including Valuation, Compliance and Regulatory services. With regards to risk management services, BOCAM has a comprehensive, transparent and independent risk management framework in place to meet the needs of both UCITS and AIFs.

Portfolio Management (Discretionary and Advisory)

Discretionary and Advisory Portfolio Management services, are offered to Institutional clients including UCITS and AIFs through BOCAM. Discretionary Portfolio Management is addressed to clients seeking active, professional management of their portfolio, in the framework of a relevant agreement which incorporates investment targets and an investment strategy that will be followed. Given the continuous increase of investment alternatives, the assignment of portfolio management to professionals has become important for all investors. Within a structured investment process, widely diversified portfolios are effectively constructed, adjusted to the needs and risk profiles of each client, offering access to global markets in various asset classes. The provision of Independent Investment Advice service, applies only to institutional clients who aspire to have the final choice for effecting or not, any investment decision in financial instruments after they receive our tailor-made investment advice.

Institutional Wealth – Global Execution Services

The Bank also offers execution services to AIFs and UCITS through its Institutional Wealth Management in collaboration with the Global Markets Execution team. A team of experienced financial professionals analyses clients’ requirements and provides innovative solutions to cater to investment or risk management needs through an extended range of products.

Global Execution services on:

- Global & Local Equities

- Bonds (Sovereign including T-Bills, Corporate)

- Mutual Funds (ETFs , UCITS, AIF) & Hedge Funds (Infrastructure, Alternative)

- Foreign Exchange Services

FX, Liability Management & Bespoke Structured Solutions

- Foreign Exchange Hedging

- Interest Rate Hedging

- Commodity hedging

- BOC eTrader -Margin Trading platform

To learn more about Bank of Cyprus, Wealth & Markets, please contact:

Head Office – Nicosia

154 Lemesou Ave., 2nd Floor, CY – 2025 Nicosia

Tel: +357 22 121 801

E-mail: [email protected]