Cyprus banks’ top priority for granting new loans in the wider field of land development are hotel complexes and units, according to the Property Lending Barometer of KPMG.

The continuous record arrivals of tourists to Cyprus and future positive indications push the business lending departments towards that direction. With five being the highest percentage point, the lending priority given by Cypriot banks to hotel development is 4.5. This is the highest percentage point in comparison with other European countries, with the exception of Croatia’s which stands at 4.7%.

Other sectors that Cypriot banks focus on are – by priority – the following: office space 3,5, industrial / logistics 2,9, commercial 2 and, surprisingly enough, residential 1,8.

All in all, however, lending to the land development sector is no longer a priority for Cypriot banks. Indeed, it marks the second lowest priority level amongst European countries with 2.75 out of a maximum of 5. Only Croatia has a lower level, which is 2.67. A significant decline was recorded since 2017, when the priority level had reached a high of 3.48.

In addition to record tourist arrivals in recent years and the growth in revenue, an increase of 838% in square meters of new hotel units was also recorded in submitted applications. The increase is a comparison between the January-September 2018 period with the corresponding one of 2017. KPMG estimate that in the 2019-2020 period an additional 7,500 new beds will be added to the hotel industry, bringing their total to 92,000 from 2018’s 85,000 beds.

Although the small in comparison rise in tourism revenue is a matter of concern, it seems not to worry hoteliers as much as those in related tourism services. Hotels with all inclusive programs and exclusive partnerships with major foreign agents appear to have increased revenue without necessarily translating this into a corresponding increased profitability.

The improvement recorded in the economic data of companies in the tourism sector is obvious in data published by the Central Bank as well. At the end of June 2018, total loans to companies in the residential and catering sector amounted to 1.8 billion euros, of which only 295 million were non-performing. By contrast, at the beginning of 2014, the total loans amounted to 2.1 billion euros, of which 1.3 billion euros were non-performing.

Read more:

Cypriots spend more on restaurants and hotels than most Europeans

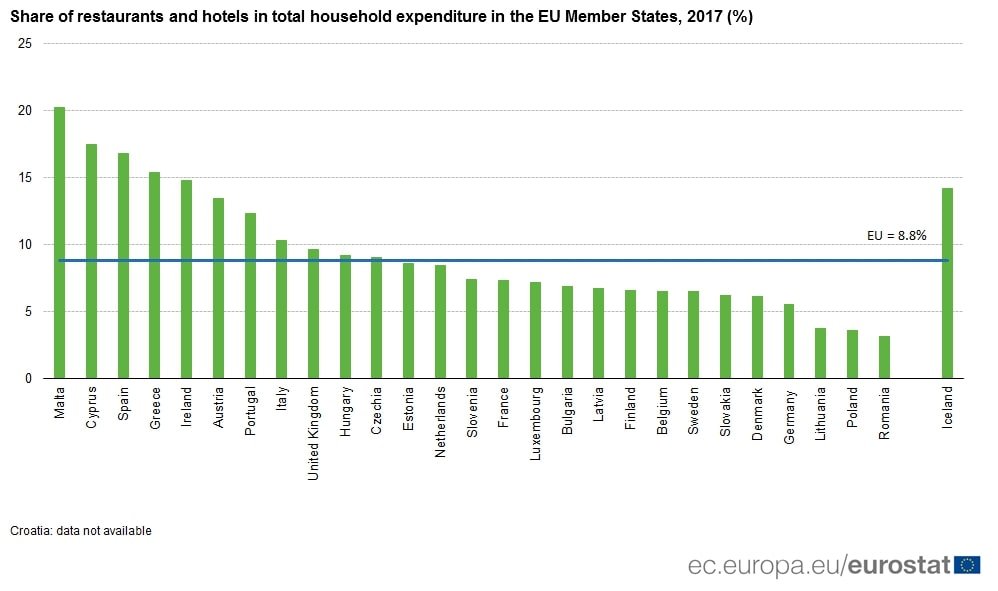

In 2017, households in the European Union (EU) spent 8.8% of their total consumption expenditure on “restaurants and hotels”. This represents a total expenditure of almost €740 bn, equivalent to 4.8% of EU GDP or €1400 per EU inhabitant. A more complete overview of household final consumption expenditure, broken down by consumption purpose, is available in this interactive infographics.

Malta, Cyprus and Spain spend highest share of household expenditure on restaurants and hotels

In the EU in 2017, the share of household expenditure devoted to “restaurants and hotels” was largest in Malta (20.2%), Cyprus (17.5%) and Spain (16.8%) ahead of Greece (15.4%) and Ireland (14.8%). At the opposite end of the scale, Romania (3.1%), Poland (3.6%) and Lithuania (3.7%) spent the lowest share of their household expenditure on “restaurants and hotels”.

The source dataset can be found here.

Share of expenditure on restaurant and hotels increased mainly in Malta

Between 2007 and 2017, the share of “restaurants and hotels” in total household expenditure grew in most Member States. In particular, the highest increase over this 10-year time period was recorded in Malta (from 15.5% of total household expenditure in 2007 to 20.2% in 2017, or a rise of 4.7 percentage points – pp) ahead of Hungary (+2.8 pp) and Cyprus (+2.7 pp). In contrast, the share of “restaurants and hotels” in total household expenditure dropped between 2007 and 2017 in Romania (from 5.0% in 2007 to 3.1% in 2017, or a decrease of 1.9 pp), followed by Slovakia (-0.6 pp) and Finland (-0.1 pp), while it remained stable in Spain.